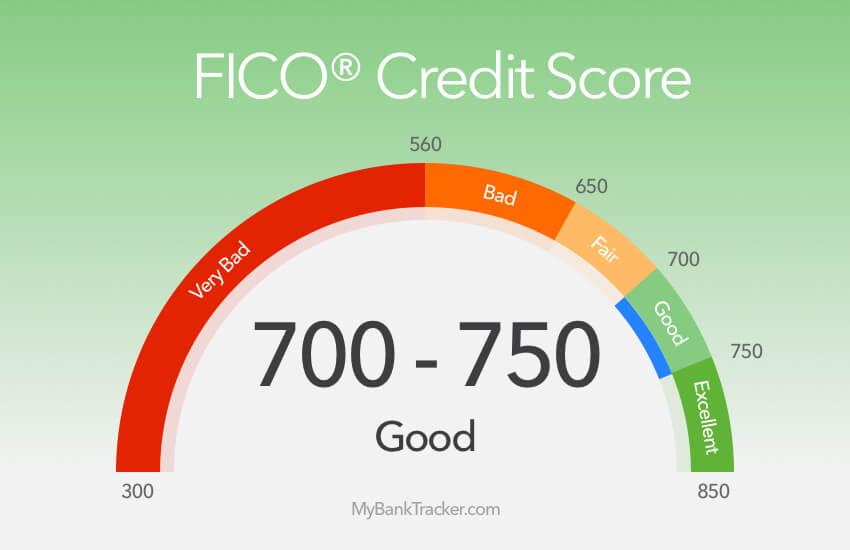

What Is a Good Credit Score?

What Is a Good Credit Score? – The approval of credit applications depends largely on the credit rating. For those who think about using credit, we are Listing Details about the credit rating.

If you apply to banks for credit or credit card, one of the first criteria for approval is the height of our credit score. The credit grade is calculated for all of our financial history. Banks can access information about you and assess whether you qualify for credit.

How Is The Credit Score Determined?

The credit rating is determined by analyzing your relationship with the banks. Your credit score determines which loans and credit cards you have used before. Credit score: factors such as payments, income status, credit applications, credit usage density determine.

The credit rating, which ranges from 1 to 1900, is classified as the most risky, medium-risk, low-risk, good and very good. When the credit rating is below 900, banks don’t get too close to lending. In general, it is seen as the ideal grade 1200 and above to get a loan. Over 1500 uses comfortable loans.

What To Do To Make Your Credit Score Higher?

If you pay your credit cards regularly, if you pay your debts, if you do not apply for Credit at very short intervals, if you pay your income and expenses are proportionate, you can make your credit score higher.

Everyone’s Credit Score?

Anyone who uses a credit card, who has previously taken any credit, who has a credit deposit account or who has a credit voucher has created a credit record.

Is a 680 credit score good or bad?

Is it safe to use credit karma?

Is a credit score of 600 good?

What would be a good credit score?