What is Apr (annual cost ratio)and why is it important?

What is Apr (annual cost ratio)and why is it important? – Under financial conditions, the APR is the appropriate discount rate, which represents the annual internal rate of return or the present net value. To put it simply, the APR shows all the real costs of a loan today and is the best measure of comparing different financial offerings on the market.

What is Apr

For example, did you hear that today’s $ 1 is worth more than $ 1 tomorrow? As vague as it may seem,this is really true. If you invest $ 1 today, tomorrow this $ 1 will be worth more than $ 1, depending on what the return rate has earned. At the same time, the opposite is true : it is better to pay a dollar tomorrow than to pay a dollar today.

Another important point in understanding the APR is the magic result of compound interest. The rate of return earned each time with the investments is added to the cash return principal. In this case, the return on the bond is more than the return on the bond. The same applies to the discount rate. If we consider this again, a certain amount of cash in the future is equivalent to less cash in today’s circumstances. ‘This money will be increased in the future. If we consider a future cost example: a $ 50 payment to be paid in 12 months today has a cost value lower than the amount to be paid in 1 month in the same amount. Because the $ 50 fee will be increased for a long time at the end of 12 months.

What does a 25% APR mean?

What is APR and interest?

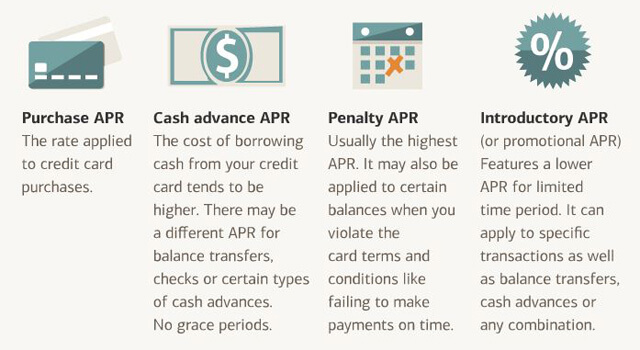

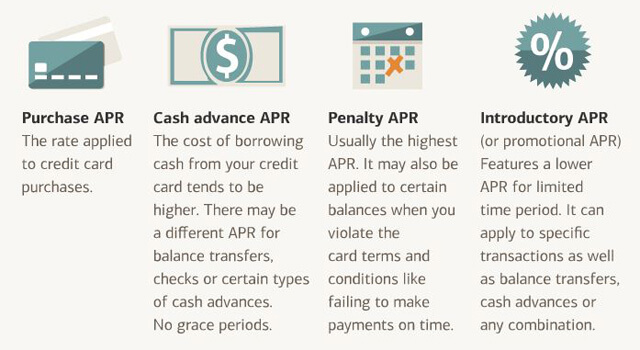

How does an APR work on a credit card?

What is the average APR?

Is a high APR good?

How does Apr work per month?