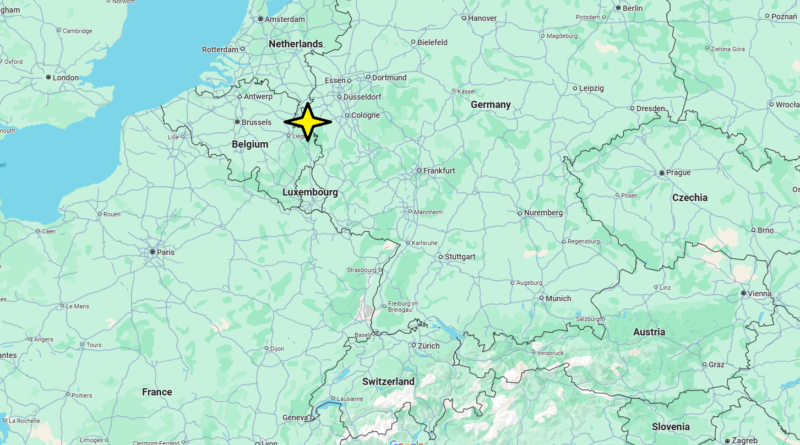

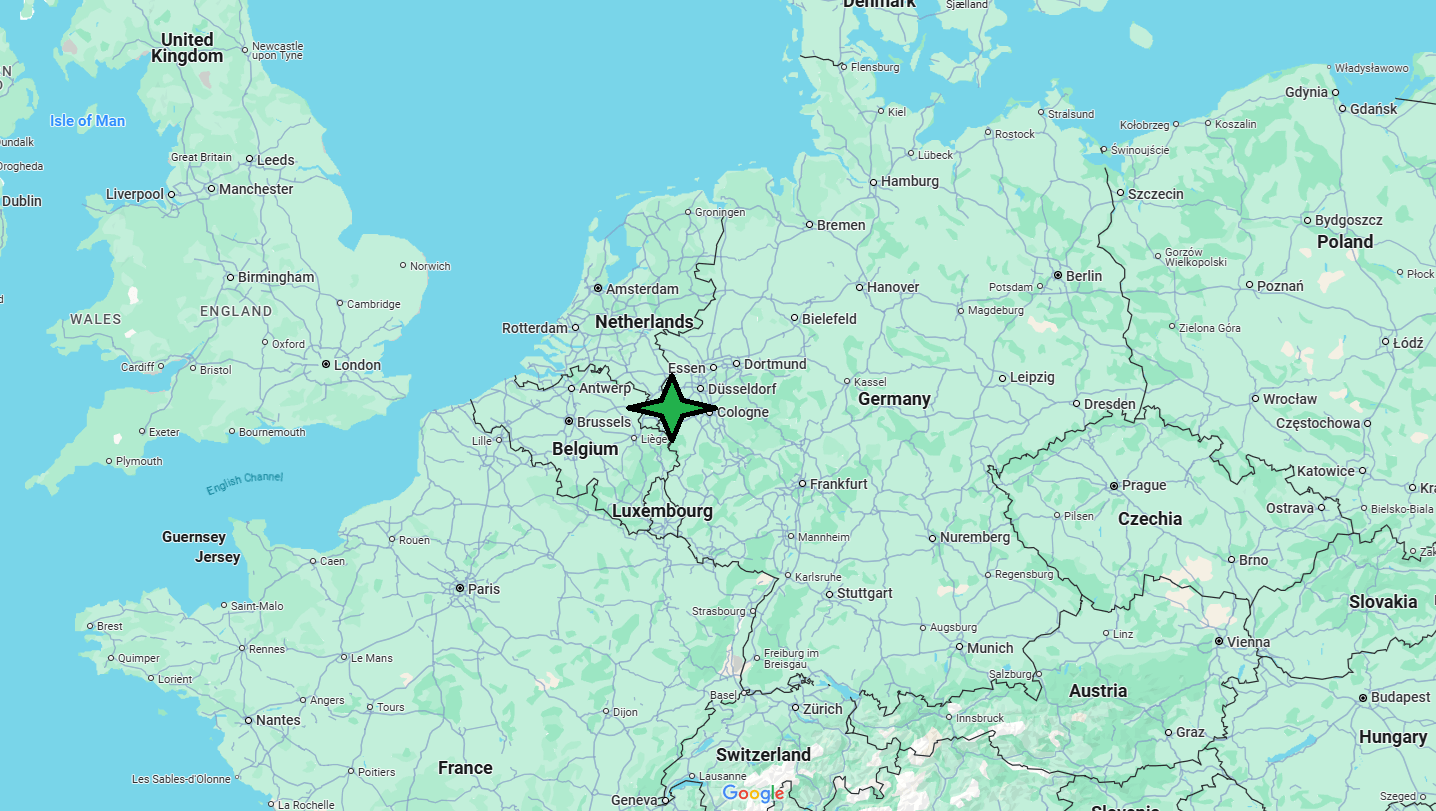

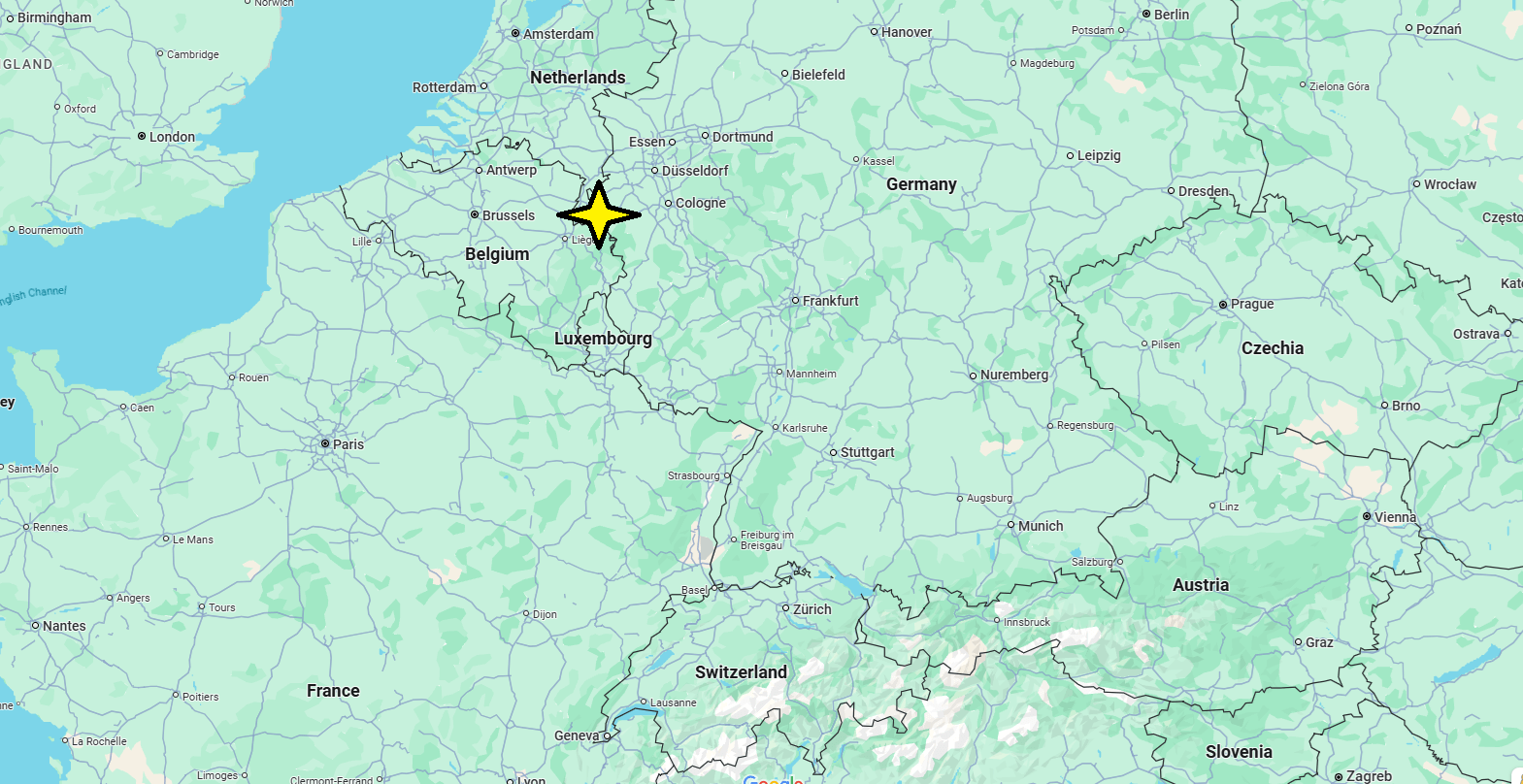

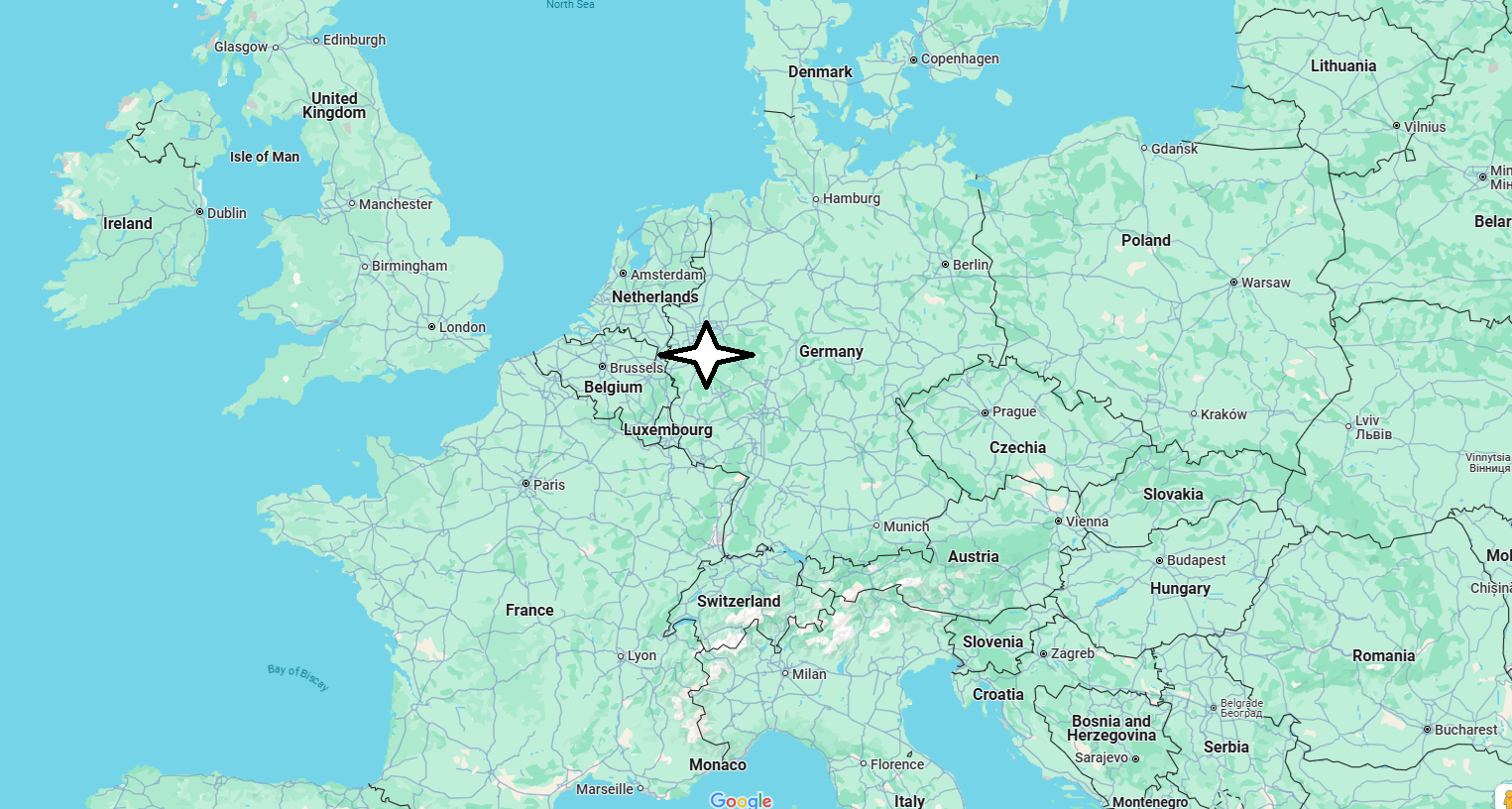

Where is Benelux?

Belgium, the Netherlands and Luxembourg are often referred to as a single bloc on the European stage, the benelux These are three founding countries of the European Union that immediately agreed in 1951 to sign the Treaty of Paris with France, Italy and West Germany. It is a link consolidated over time, which also pre-exists the very creation of the community process. In fact, there was a customs union between the three countries that the respective governments in exile began to create in 1944 in London, but which came into force only four years later. This union set an important example for the future development of the European Economic Community.

After analyzing the political situation of other EU member States in the run-up to the European elections in May, let us now describe the political climate and forecasts for these three countries.

Which country is Benelux in?

A term by which, from the initial syllables of their names in the respective national language (Belgique, Neederland, Luemb Concluded in London on 5 September 1944, under pressure from Anglo-Saxon diplomacy itself, this convention, which already has a precedent in the Ouch Convention of 18 July 1932, was ratified on 29 October 1947 and was designed, also to mitigate the latent hostility of Walloon public opinion that believes itself sacrificed to Holland, with a gradualistic criterion of three stages: customs commonality, customs union and complete economic union. Benelux has already completed the first phase and is about to surpass the others under the guidance of the Council of Economic Union, which unlike the other two bodies (Administrative Council of Customs and Council of Trade Agreements) has a function that goes beyond the framework of the simple customs union. In this consolidation the Benelu is favored by the evolution of the international situation; the Treaty of Bruelelles of 17 March 1948 between Benelux, England and France, and the subsequent completion of the Paris Agreement of 17 April establishing an Advisory Committee and a Military Committee, tend increasingly to give this customs union a political character and substance.

The customs union between Belgium-Luxembourg and the Netherlands, a prelude to a full-fledged economic union, became effective on 1 January 1948 with the entry into force of a single customs tariff and exemptions from DAZ between the three contracting countries. Faced with the amount and difficulty of the work still to be done, the part already carried out may seem small; but, in addition to the importance of the first step, it must be recognized that this was also not easy, given the fundamental differences between the systems previously followed by Belgium and Holland. While, in fact, the Belgian tariff was based on the systematic nomenclature of the League of Nations and consisted of specific dazî Moreover, in the Netherlands, dazs were mainly fiscal, while in Belgium they were mostly protective and therefore higher. A compromise was eventually achieved and the Belgian nomenclature was combined with the Dutch ad valorem taxation system.

The work of unifying indirect taxes on consumption and those on transfers, which must be the second stage, will be longer and more complex, and the work of harmonizing the economic and social legislation of the three countries in such a way as to allow the formation of a single level of prices and wages will be even more complicated .î Belgian economic policy is based on criteria which are very different from the Dutch guidelines and many interests are also at stake. The Ministers of Belgium, Luxembourg and the Netherlands, meeting at Ardenne Castle on 7-8 June 1948, however, officially declared that economic union could become a reality on 1 January 1950 and in the meantime established a set of preliminary measures, such as: the gradual abandonment of the production subsidy policy; the progressive abolition of binding legislation, especially in the matter of licences and quotas; the levelling of tax burdens and the mutual communication of investment plans in order to achieve greater complementarity between the three countries ‘ economies.